New Australians struggle in the housing market

Newly arrived migrants and refugees are being left stuck at the bottom of the home ownership ladder as Australia’s property market boom continues unabated.

Newly arrived migrants and refugees are being left stuck at the bottom of the home ownership ladder as Australia’s property market boom continues unabated.

Recent data shows property price rises outstripping wage increases, housing costs rises across all types of dwellings and falling rates of ‘housing affordability’. ‘Housing affordability’ relates to a person’s ability to pay for their housing.

It is a complex issue affected by local housing and labour markets as well as larger economic, environmental and social forces. When people struggle to meet the cost of housing, researchers describe it as ‘housing affordability stress’.

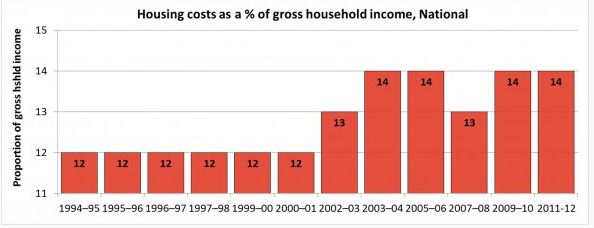

In Australia, a percentage of income spent on housing costs is generally used to estimate the number of households affected.

In common use is a ‘30/40 rule’. This means that if a household is spending more than 30 per cent of its income on housing and its income is in the bottom 40 per cent of earners, it is suffering affordability stress.

In 2002-2003, 862,000, or 15.8 per cent, of all Australian households were experiencing housing stress. The rate among low income households was 28.2 per cent.

By 2006, the number of households experiencing stress had risen to 22 per cent.

Among people new arrivals to Australia, there are significant numbers of single-income or low-income families with dependent children.

The data, compiled by the Australian Housing and Urban Research Institute (AHURI), shows housing affordability stress is particularly acute for private renters, single-person households under the age of 65 and low-income home purchasers.

Households with dependent children were at greatest risk of spending prolonged periods of time in housing stress, it showed.

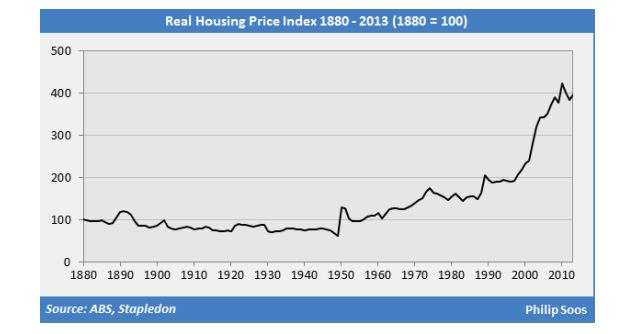

The research found that between 1960 and 2006 real house prices increased at an average of 2.7 per cent each year compared to 1.9 per cent growth in real incomes. Currently, mean weekly housing costs in Australia are $468 for people with a mortgage and $345 for renters.

In 2000, housing costs comprised 12 per cent of gross household income across Australia. In 2012 that figure had risen to 14 per cent. And since 1990 the Real Housing price Index has doubled.

“The decline in house purchase affordability is a structural problem created by house prices growing faster than incomes over the last half century,” said housing market researcher Valerie Sampson.

“House and rental price instability has significant consequences for the broader economy because it affects household spending patterns and generally reinforces economic volatility,” she said.

“A lack of affordability in particular areas affects employment. A generation unable to purchase homes leads to widening and unsustainable inequalities and housing affordability problems push people into more marginal forms of housing.

“Housing affordability differences between regional areas and major cities can affect people’s choices about where to live. For example mining or resource booms can create local housing affordability problems, including under-supply and high rents in remote areas.

“All the research says that we need better land development strategies that are actively planned and managed to satisfy housing needs during and after a boom,” Ms Sampson said.